Meaning and Definition of Ledger

A ledger is the main book of accounts in accounting. It's also known as the book of final entry. This book holds a summarized record of all accounts such as Assets, Liabilities, Capital, Revenue, and Expenses.

The word ‘ledger’ comes from the Latin word ‘ledger,’ meaning ‘to contain.’ Since a ledger contains all accounts, the name fits perfectly.

A ledger contains accounts where all transactions of a business or other accounting units are classified either in detail or summary form.

Importance of a Ledger

- Summarized Record: A ledger provides a summarized record of all transactions in the form of Asset, Liabilities, Expenses, and Income accounts.

- Ease of Information: It helps in easily finding out how much is owed to suppliers, how much is receivable from customers, etc. This is done through accounts like Debtors and Creditors.

- Trial Balance Preparation: It is essential for preparing a trial balance.

- Financial Position: The financial status of the business can be easily known through various Asset and Liability accounts.

- Income Statements: Different types of income statements can be prepared based on the balances shown by various ledger accounts.

- Control Tool: The ledger shows accounts of various expenses with their balances, making it a useful control tool.

- Planning and Forecasting: The results shown in the ledger help management in planning and forecasting future actions.

Contents of a Ledger

A ledger is a bound book with several pages, each serially numbered. Each account has a separate page. The page number is called the 'Ledger Folio' (L.F.). Each ledger account is divided into two sides: the left side is the debit side (Dr.), and the right side is the credit side (Cr.). Every ledger has an index in alphabetical order for quick reference. Both sides of the ledger have four columns:

A) Date: The date of the transaction is written here, including the year, month, and day.

B) Particulars: The name of the account where the corresponding credit or debit is found is mentioned here. Entries on the debit side start with ‘To’ and on the credit side with ‘By’.

C) Journal Folio (J.F.): This column shows the page number of the journal from which the entry was transferred to the ledger.

D) Amount: This column shows the amount for which an account is debited or credited.

Example Ledger Account: Cash Account

Index:

- Cash Account:

Page 1 (Ledger Folio 1):

|

Date |

Particulars |

J.F. |

Amount |

Date |

Particulars |

J.F. |

Amount |

|

|

2024-01-01 |

To Capital A/c (John Doe) |

1 |

9,000 |

2024-01-05 |

By Rent Expense A/c (XYZ Properties) |

2 |

1,000 |

|

|

2024-01-03 |

To Sales A/c (ABC Corp) |

3 |

5,000 |

2024-01-10 |

By Supplies A/c (Office Supplies Inc) |

3 |

2,500 |

|

|

2024-01-07 |

To Loan A/c (Big Bank) |

4 |

2,000 |

2024-01-15 |

By Wages A/c (Jane Smith) |

4 |

1,500 |

|

|

2024-01-12 |

To Accounts Rec. A/c (Acme Co) |

5 |

3,000 |

2024-01-20 |

By Utilities A/c (City Power) |

5 |

1,200 |

Example Ledger Account: Sales Account

Index:

- Sales Account:

Page 2 (Ledger Folio 2):

|

Date |

Particulars |

J.F. |

Amount |

Date |

Particulars |

J.F. |

Amount |

|

|

2024-01-03 |

By Cash A/c |

3 |

5,000 |

|||||

|

2024-01-08 |

By Cash A/c (XYZ Corp) |

6 |

4,000 |

|||||

|

2024-01-12 |

By Accounts Rec. A/c (LMN Ltd) |

7 |

2,500 |

|||||

|

2024-01-15 |

By Cash A/c (Jane's Boutique) |

8 |

1,800 |

Explanation:

- Date: The date of each transaction is recorded.

- Particulars: On the debit side, entries start with 'To' and show the account credited along with the name of the person or company. On the credit side, entries start with 'By' and show the account debited along with the name of the person or company.

- J.F. (Journal Folio): This column shows the page number of the journal from where the entry is transferred.

- Amount: This is the amount debited or credited to the account.

This structure, with added names of persons and companies, makes the ledger more realistic and specific, helping in organizing the transactions and making it easy to trace back to the original entries in the journal.

Do you know?? How computerised ledger account looks In modern accounting system we use various accounting softwares for recording the transactions.

Creating Ledgers in Tally

In modern accounting, we use software like Tally, QuickBooks, or Xero to keep track of financial transactions. These programs help us create and manage ledger accounts easily. Here’s how you can create a ledger in Tally:

Steps to Create a Ledger in Tally Prime

A) Open Tally Prime: Start Tally Prime on your computer.

B) Select Company: Choose the company for which you want to create the ledger.

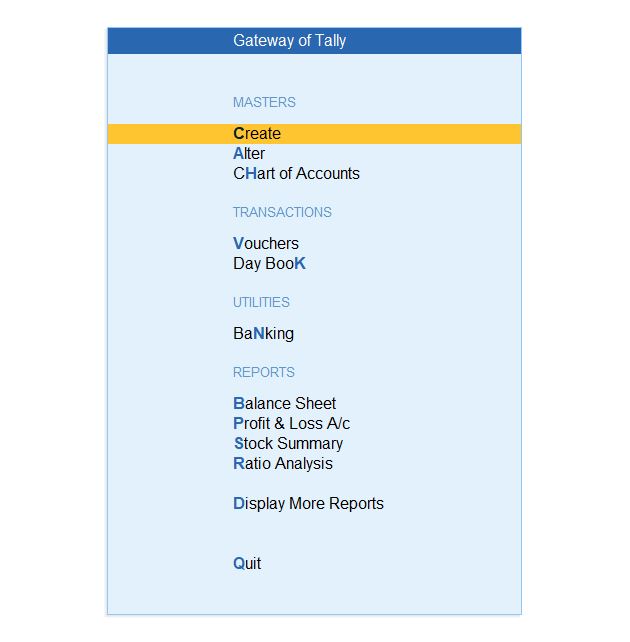

C) Gateway of Tally: You will see the main screen, called the Gateway of Tally.

Creating a Ledger

A) Go to Create:

From the Gateway of Tally, go to Create.

C) Select Ledger:

In the Create menu, select Ledger.

On the Ledger Creation screen, fill in the following details:

A) Name: Enter the name of the ledger (e.g., "Sales Account").

B) Under: Select the group this ledger belongs to (e.g., "Sales" for a sales ledger).

C) Mailing Details (Optional): Enter any address details if needed.

D) Tax Information (Optional): Provide any tax details if applicable.

E) Opening Balance: If the ledger already exists, enter the starting balance. If it’s new, leave this as zero.

Example: Creating a Sundry Creditors Ledger

- Name: ABC Corporation

- Under: Sundry Creditors

- Mailing Details: (Optional)

- Tax Information: (Optional)

- Opening Balance: 0

Saving the Ledger

Once you have entered all the details:

- Save the Ledger: Press Ctrl+A to save.

To see the ledger after creating it:

A) Go to Gateway of Tally:

Return to the Gateway of Tally from the main screen.

B) Go to Display:

From the Gateway of Tally, select Display.

C) Select Ledgers:

In the Display menu, choose Ledgers.

D) Choose Ledger:

Select the ledger you want to view from the list.

This will show you the ledger and all its details and transactions.

Using Tally Prime makes it easy to keep track of your finances accurately and efficiently.

Posting Entries from Journal/Subsidiary Books to Ledger

When transactions happen, they are first recorded in various books called journals or subsidiary books. These books are the first place where transactions are noted. From these original books, the information is then moved to the ledger. This process of moving entries to the ledger is called 'posting.'

The Recording Process

Recording transactions in the ledger involves several steps:

1. Ledger Posting: First, take the journal entries and transfer them to the ledger. This means copying each entry from the journal into the right ledger account.

2. Open Ledger Accounts: Open the necessary ledger accounts with clear headings, such as "Cash," "Sales," or "Expenses."

3. Opening Balance: If a ledger account has an opening balance, post it first. Write ‘To balance b/d’ for a debit balance or ‘By balance b/d’ for a credit balance. This sets the correct starting amount for the account.

4. Date Column: Write the date of each transaction in the date column of the ledger, including the day, month, and year.

5. Particulars Column: On the debit side of the ledger, write the name of the account that is credited in the journal entry. On the credit side, write the name of the account that is debited. For example, if recording a sale, write "Sales" on the credit side and "Cash" or "Accounts Receivable" on the debit side, depending on how the sale was made.

This step-by-step method ensures all transactions are correctly recorded in the ledger, making it easier to keep track of a business's finances. The ledger is a detailed record of all financial transactions, helping to prepare financial statements and understand the business's financial health.