How to Withdraw Your EPF Online: Step-by-Step Instructions

Withdrawing your Employee Provident Fund (EPF) online is now easier than ever, thanks to the digital initiatives by the Employees' Provident Fund Organisation (EPFO). Whether you're looking to withdraw your EPF funds due to retirement, a job change, or specific financial needs, this detailed guide will walk you through the entire process step-by-step.

Step 1: Activate Your UAN Number

Before you can proceed with an online withdrawal, you must ensure that your UAN (Universal Account Number) is activated. The UAN is a unique number assigned to every EPF member. If you haven't activated your UAN, follow these steps:

- Visit the UAN Member Portal: Go to the EPFO UAN Member Portal. Link >> https://unifiedportal-mem.epfindia.gov.in/memberinterface/

- Click on 'Activate UAN': You'll find this option on the right-hand side of the page.

- Fill in the Required Details: Enter your UAN, name, date of birth, mobile number, and email address.

- Submit and Verify: After filling in the details, click on 'Get Authorization Pin'. You will get an OTP on your registered mobile number. Enter this OTP to activate your UAN.

Step 2: Check Your EPF Balance

Before initiating the withdrawal process, it’s a good idea to check your EPF balance. Here’s how you can do it:

- Log in to the EPFO Member Portal: Use your UAN and password to log in. Link >> https://passbook.epfindia.gov.in/MemberPassBook/login

- Go to 'View Passbook': Once logged in, navigate to the 'View Passbook' option.

- Download Your Passbook: You can now see and download your EPF passbook, which contains details of your EPF contributions and the current balance.

Step 3: Log in to the EPFO Site

Now that your UAN is activated and you’ve checked your balance, follow these steps to log in and start the withdrawal process:

- Visit the EPFO Website: Open the EPFO website and click on the UAN Member Portal link. https://unifiedportal-mem.epfindia.gov.in/memberinterface/

- Log in with Your UAN and Password: Enter your UAN number, password, and the captcha code.

- Verify Your Identity: You will receive an OTP on your registered mobile number. Use this OTP to confirm your identity.

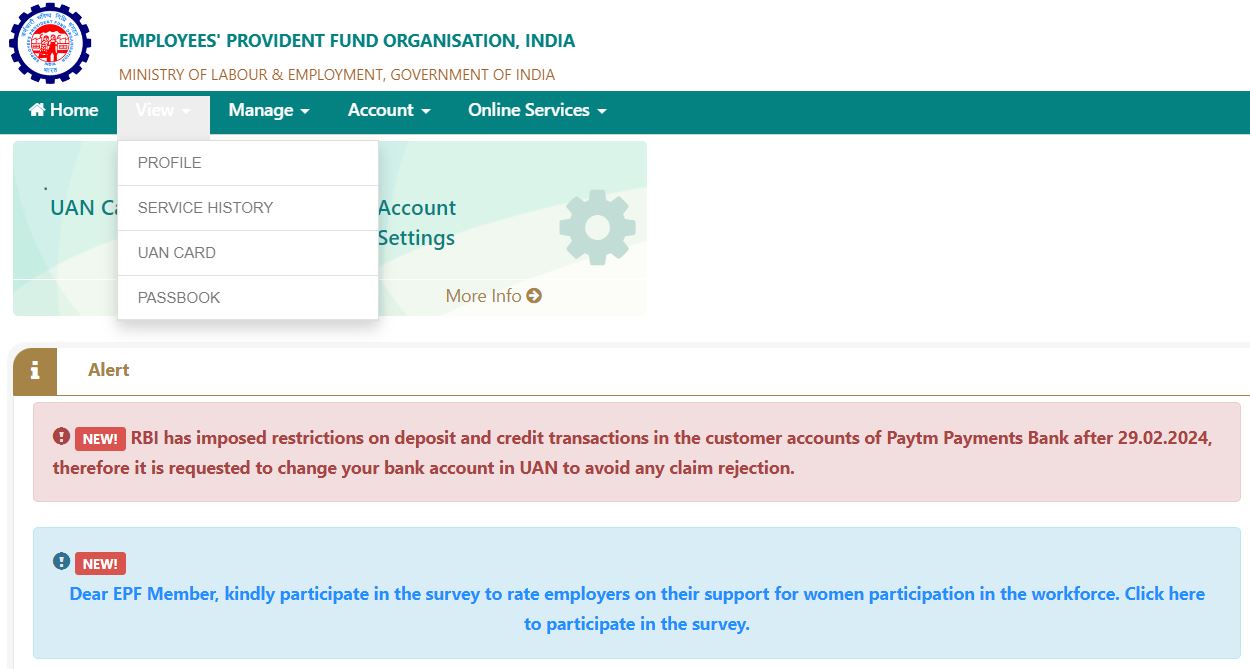

Step 4: Navigate to the Online Services Tab

Once you are logged in, you’ll find yourself on the home page of your EPF account. Here’s what to do next:

- Click on 'Online Services': This tab is located at the top menu of the page.

- Select 'Claim (Form-31, 19, 10C & 10D)': Click on this option to proceed to the claims section.

Step 5: Understanding the Forms

Before you select a form, it’s important to understand the purpose of each:

- Form 31: This form is used for partial withdrawals or advances from your EPF account. It can be used for purposes such as medical treatment, higher education, marriage, home renovation, etc.

- Form 19: This form is used for the final settlement of your EPF account. You use this form when you retire or permanently leave your job.

- Form 10C: This form is used to claim pension withdrawal benefits under the Employees' Pension Scheme (EPS) if you have rendered less than 10 years of service.

- Form 10D: This form is used to claim a monthly pension if you have completed 10 years of service and are eligible for pension benefits.

Step 6: Submit Your Claim

To submit your claim, follow these steps:

- Select the Appropriate Form: Based on your requirement, select Form 31, Form 19, Form 10C, or Form 10D.

- Verify KYC Details: Ensure that your KYC (Know Your Customer) details, such as Aadhaar, PAN, and bank details, are updated and verified.

Step 7: Enter Bank Details

- Enter Your Bank Account Number: Make sure the bank account number you enter is linked to your EPF account.

- Click on 'Verify': Verify the bank account details.

Step 8: Sign the Certificate of Undertaking

After verifying your bank details, a pop-up will appear asking you to sign a Certificate of Undertaking. Here’s how to proceed:

- Click 'Yes' to Proceed: This indicates your agreement to the terms and conditions.

- Confirm Your Agreement: Ensure you understand and agree to the undertaking terms.

Step 9: Apply for the Claim

- Select the 'I Want to Apply For' Option: Choose the appropriate form (Form 31, Form 19, Form 10C, or Form 10D) from the drop-down menu.

- Enter Your Permanent Address: Fill in your current permanent address accurately.

- Click on 'Proceed for Online Claim': This will take you to the next step of the claim process.

Step 10: Authenticate Your Details

- Receive OTP on Your Registered Mobile Number: An OTP will be sent to your mobile number registered with UIDAI (Aadhaar).

- Enter the OTP to Authenticate: Enter the OTP in the provided field to authenticate your details.

Step 11: Submit the Claim Form

After authenticating your details, you are ready to submit your claim form:

- Review Your Information: Double-check all the information you have entered to ensure accuracy.

- Submit the Online Claim Form: Click on 'Submit' to finalize your claim application.

Common Questions About EPF Withdrawal

Can I Withdraw My 100% PF Amount?

You can withdraw 100% of your PF amount under certain conditions:

- Retirement: When you retire at the age of 58.

- Permanent Disability: If you are permanently disabled and unable to work.

- Unemployment: If you have been unemployed for more than two months.

For partial withdrawals, specific conditions such as marriage, education, medical treatment, or home purchase apply.

How Long Does It Take for EPF Withdrawal Online?

The time it takes for the EPF withdrawal process to be completed online generally ranges from 10 to 15 working days, Recently EPFO Settled amount within 3 to 4 days. However, this can vary based on factors such as the accuracy of the information provided and the completeness of your KYC details.

What Is the PF Withdrawal Limit?

The withdrawal limit depends on the reason for withdrawal:

- Medical Treatment: You can withdraw up to 6 times your monthly basic salary and dearness allowance or the total employee's share plus interest, whichever is lower.

- Marriage/Education: You can withdraw up to 50% of your employee's share plus interest.

- Home Purchase/Construction: You can withdraw up to 90% of the total EPF balance.

Do I Need to Submit Form 15G?

Form 15G is required if your PF withdrawal amount exceeds ₹30,000 and if you want to ensure that no TDS (Tax Deducted at Source) is deducted from your withdrawal amount. Form 15G is applicable only if your total income is below the taxable limit.

Is Linking PAN with Aadhaar Necessary?

Yes, linking your PAN with Aadhaar is necessary if your PF withdrawal amount exceeds ₹30,000. This ensures compliance with KYC norms and helps in avoiding TDS deductions.

Final Thoughts

Withdrawing your EPF online is a convenient process that saves time and effort. By following the detailed steps outlined above, you can successfully navigate the EPFO portal and submit your claim with ease. Always ensure that your personal and bank details are accurate and up-to-date to avoid any delays or rejections in your withdrawal process.

For any further queries or assistance, you can visit the official EPFO website or contact their customer support. Happy claiming!

.JPG)

.JPG)