If you've been following the news about India's economy, you might have heard that our debt has been steadily increasing over the past few decades. But what does this really mean for us? Why is India borrowing so much, and what are the potential consequences for the average person? Let’s break it down in simple terms.

Why Is India’s Debt Growing?

There are several reasons why India's debt has been on the rise. It’s not all bad, but there are some challenges we need to keep in mind.

- Spending More Than We Earn (Fiscal Deficit): India has been spending more money than it makes. This is called a "fiscal deficit." To cover this gap, the government borrows money. It's like how a person might use a credit card if their paycheck isn’t enough to cover their expenses. While borrowing helps meet the short-term needs, it adds up over time.

- Economic Shocks Like COVID-19: Big global events like the 2008 financial crisis and the recent COVID-19 pandemic had a huge impact on India's economy. To boost the economy during these tough times, the government had to spend more. This meant borrowing even more money.

- Building Infrastructure: India has been working hard to improve roads, bridges, railways, and other infrastructure. These are long-term investments that will help the economy grow, but they require a lot of money upfront, often leading to borrowing.

- Welfare Programs: The government spends a lot of money on programs that help the poor, provide healthcare, education, and other services. While these are important for social welfare, they also contribute to the rising debt.

Managing Debt: What Can Be Done?

Reducing debt isn’t easy, but it’s important to avoid future problems. There are a few strategies India could use to manage its debt better:

- Spend Smarter: The government needs to carefully plan where it spends money, cutting unnecessary expenses and ensuring that what’s spent creates a positive impact on the economy.

- Boost Economic Growth: When the economy grows, the government earns more revenue through taxes. A growing economy can help reduce the debt-to-GDP ratio, which means the debt becomes more manageable.

- Restructure Debt: This means renegotiating the terms with creditors (those who lend money) to reduce the short-term burden of repaying debt.

Should We Be Worried About Rising Debt?

Yes, we should be concerned, but not panicked. A rising debt, if not properly managed, can lead to a few serious problems:

- More Interest Payments: The more debt India has, the more money the government needs to spend on interest payments. This means less money is available for things like infrastructure, healthcare, and education.

- Inflation Risk: If the government tries to print more money to pay off the debt, it could cause inflation, which makes everything more expensive for people.

- Currency Depreciation: A lot of debt can weaken the Indian rupee. When the rupee loses value, it becomes more expensive to import goods, which can push up prices and hurt the economy.

Understanding External Debt and Public Debt

India's total debt can be divided into two main types: external debt and public debt. Each has its own set of challenges and risks, so it's important to understand how they differ.

What Is External Debt?

External debt is the money that India borrows from foreign lenders, such as international organizations, other governments, and foreign private investors. This debt is usually taken in foreign currencies like the US dollar or the Euro.

External Debt Trends in India (2014–2024)

- 2014: $475 billion

- 2016: $510 billion

- 2018: $542 billion

- 2020: $558 billion

- 2022: $620 billion

- 2024 (estimated): $655 billion

This shows that India’s external debt has increased by about 38% in the last decade.

Key Challenges with External Debt:

- Currency Risk: Since external debt is borrowed in foreign currencies, if the Indian rupee loses value, it becomes more expensive to repay that debt.

- Rising Interest Rates: Global interest rates have been increasing, which makes it costlier for India to borrow or refinance this debt.

- Impact on Foreign Exchange Reserves: India needs to keep enough foreign currency reserves to manage this debt. If reserves fall, it can cause problems for the economy, affecting trade and investment.

What Is Public Debt?

Public debt, also called government debt, includes all the money the government borrows, both within India and from foreign sources. Public debt can be classified into two main types:

- Internal Debt: This is debt borrowed from Indian banks, financial institutions, and citizens through government bonds and securities.

- External Debt: As we discussed earlier, this is debt borrowed from foreign lenders.

Public Debt Trends in India (2014–2024)

- 2014: ₹58 trillion

- 2016: ₹65 trillion

- 2018: ₹71 trillion

- 2020: ₹95 trillion

- 2022: ₹105 trillion

- 2024 (estimated): ₹115 trillion

India’s public debt has almost doubled in the last decade. Most of this debt is borrowed internally, meaning it’s held by Indian institutions and people.

Key Challenges with Public Debt:

- Bigger Fiscal Deficit: Rising public debt leads to a higher fiscal deficit, which can make investors nervous and lead to a lower credit rating for India.

- Interest Payments: As public debt increases, the government has to spend more on interest payments, leaving less money for essential services and development projects.

- Crowding Out Private Investment: When the government borrows a lot, it can make it harder for private businesses to get loans. This can hurt overall economic growth.

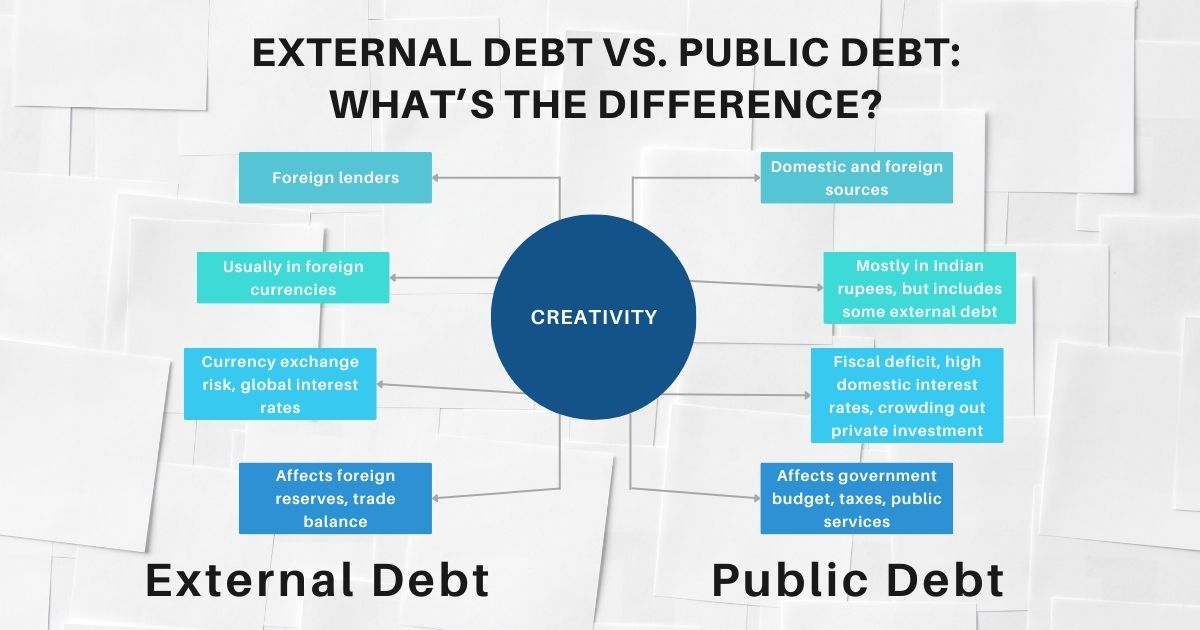

External Debt vs. Public Debt: What’s the Difference?

Here’s a quick comparison to understand the key differences between external and public debt:

|

Aspect |

External Debt |

Public Debt |

|

Who We Borrow From |

Foreign lenders |

Domestic and foreign sources |

|

Currency |

Usually in foreign currencies |

Mostly in Indian rupees, but includes some external debt |

|

Risks |

Currency exchange risk, global interest rates |

Fiscal deficit, high domestic interest rates, crowding out private investment |

|

Impact on Economy |

Affects foreign reserves, trade balance |

Affects government budget, taxes, public services |

India’s Debt Situation in 2024 (Estimates)

Here’s what India’s debt might look like by the end of 2024:

- External Debt: $655 billion

- Public Debt: ₹115 trillion

While external debt is smaller in comparison to public debt, it still plays a significant role in determining India’s currency stability and foreign reserves. Public debt, on the other hand, directly impacts the government's budget, taxes, and its ability to fund important projects and programs.

Challenges in Reducing India’s Debt

Reducing debt is easier said than done. Here are some of the major challenges India faces:

- Slow Revenue Growth: The government’s revenue, especially from taxes, isn’t growing as fast as its expenditure, making it harder to reduce the debt.

- Political Pressure: Cutting spending on social welfare programs can be politically unpopular, even if it’s necessary to reduce debt.

- Global Factors: Factors beyond India’s control, like global oil prices and international recessions, can also make it difficult to reduce debt.

Final Thoughts

India’s growing debt is both a challenge and an opportunity. While borrowing is necessary to fuel economic growth and development, managing this debt properly is crucial to ensuring a stable and prosperous future. By being careful with how much we borrow, and focusing on long-term growth, India can balance its debt and create a stronger economy for the future.

Click here to Read - Bridging the Economic Gap: A comparison of American, Chinese, and Indian GDP

.png)

%20(1).png)