How to Effectively Use GST DRC-03A for Accurate Tax Payments and Adjustments

The Goods and Services Tax Network (GSTN) has introduced a new form, GST DRC-03A, to make it easier to adjust voluntary payments against specific demand orders issued by GST authorities. This update is a big step towards making tax records more accurate and giving taxpayers more clarity. In this article, we will go over what gst drc-03a is, how to file it, and how it links to DRC-03 payments. We'll also cover advisory tips, GST DRC-03A form payment link guidelines, and how to fix mistakes in these forms.

What is Form GST DRC-03A?

Form GST DRC-03A lets taxpayers apply tax payments they've already made to specific GST demand orders. The best part of this form is the new field where you can enter the Demand Order Number, making sure that payments are matched to the right demand. This solves the common issue of payments not being linked to specific orders, which often caused errors in the Electronic Liability Register.

Now, taxpayers can easily reconcile their payments with the GST authorities, reducing errors and cutting down on the need for extra clarifications or disputes. This form is especially helpful for big businesses that deal with multiple demand orders, as it simplifies keeping track of payments.

How to File GST DRC-03A?

Filing gst drc-03a is simple:

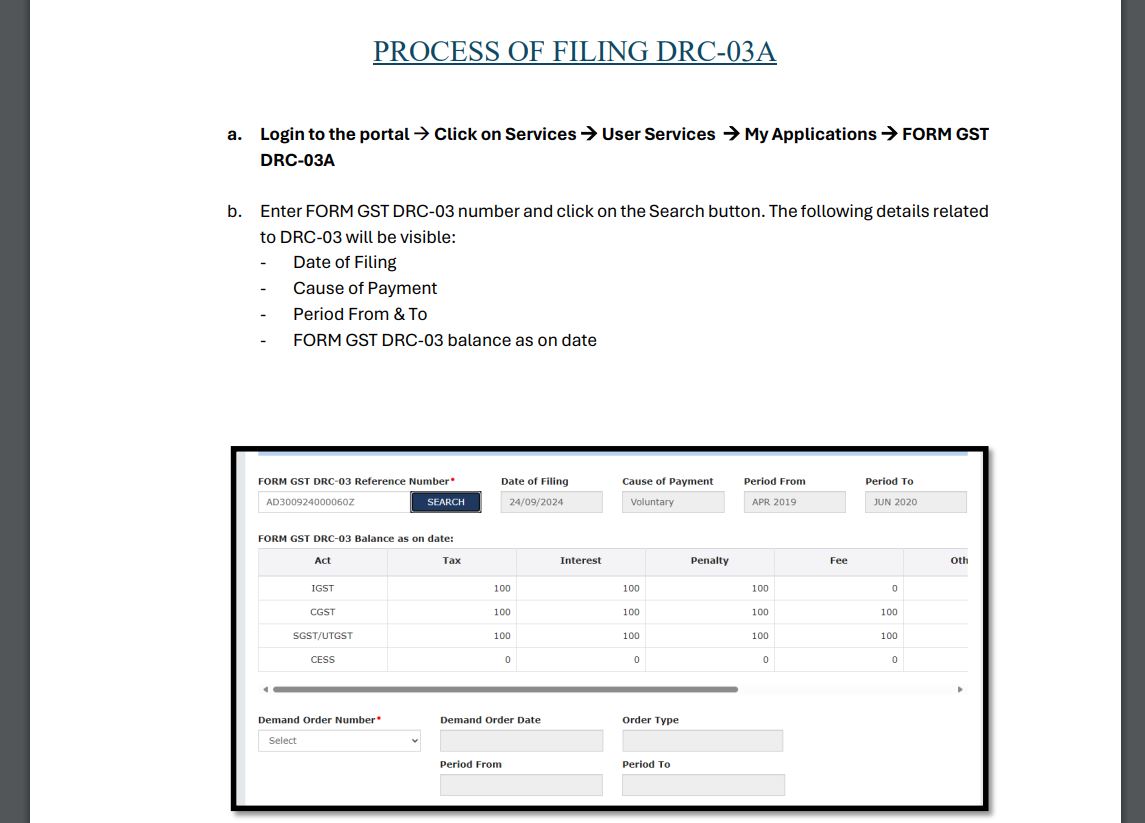

- Access the GST Portal: Log in to the GST portal using your login details.

- Navigate to DRC Forms: Go to the "Services" menu, then "User Services," and select "My Applications."

- Select Form GST DRC-03A: Choose form gst drc-03a from the available forms.

- Enter Details: Fill in the required details, like the Demand Order Number and the amount you want to adjust.

- Submit the Form: Check all the details and submit the form.

- Acknowledgement: Once submitted, an acknowledgement will be generated. Save or download this for your records.

Make sure to double-check all the entries before you submit to avoid any mistakes that could delay the process or lead to more questions from the GST authorities. Keeping a copy of the acknowledgement is helpful as proof of submission in case of any issues.

How to Link DRC-03 with DRC-03A?

Linking form gst drc-03a with DRC-03 ensures that payments made using DRC-03 are correctly applied to the specific demand orders. Here’s how to link them:

- Locate the Demand Order: Find the demand order for which the payment was made using DRC-03.

- Access DRC-03A: Log in to the GST portal and go to form gst drc-03a.

- Enter DRC-03 Details: Input the details of the DRC-03 payment, including the payment reference number.

- Submit the Form: Once all details are correctly entered, submit the gst drc-03a form.

This linking process helps maintain a clear record of payments, making it easier for both taxpayers and GST officials to track and verify transactions. It also helps avoid double taxation or missed payments, which can happen when records are not properly linked.

GST DRC-03A Form Advisory

The introduction of gst drc-03a form is a welcome change for taxpayers, as it clears up the confusion caused by unlinked payments. Taxpayers are advised to use this form to make sure their payments are correctly recorded against the right demand orders.

Regularly checking your GST account and matching payments with demand orders can prevent future problems. Tax consultants and accountants should also learn how to use gst drc-03a form to help their clients effectively.

Which demand orders are eligible for adjustment through Form GST DRC-03A?

Form GST DRC-03A can be used to adjust any pending demand orders, including those in DRC-07, DRC-08, MOV-09, MOV-11, and APL-04, as long as the full payment hasn't been made yet.

Who is eligible to file the DRC-03A form?

Taxpayers who have received a demand in Form GST DRC-07, DRC-08, MOV-9, MOV-11, or APL-04, and have already made the payment through Form GST DRC-03 under the 'Voluntary' or 'Others' categories, are eligible to file the DRC-03A form.

GST DRC-03A Form Payment Link

To make things easier, the GST portal provides a direct link to file and submit gst drc-03a form. This link is found under the "Services" section in the GST portal, making it easier for taxpayers to manage their demand adjustments.

Using the gst drc-03a form payment link simplifies the process of submitting payments and ensures that the payments go to the right demand orders. It’s a good idea to bookmark this link for quick access during future transactions.

How Do I Rectify DRC-03 in GST?

If you need to fix a DRC-03 form, follow these steps:

- Identify the Error: Look at your submitted DRC-03 form for any mistakes.

- Submit an Amendment Request: Use the "My Applications" section to submit a request to fix the DRC-03 form.

- Provide Correct Details: Enter the correct details and submit the amendment form.

- Await Approval: The GST authorities will review your request and respond.

Fixing errors quickly helps keep your tax records accurate and in line with GST rules. Keeping detailed records of all submissions and correspondence can be helpful if more follow-up is needed.

Read Also: How the New Invoice Management System (IMS) Makes GST Filing Easier

How to File DRC-03 After Payment

Filing DRC-03 after making a payment involves these steps:

- Log In to GST Portal: Use your login details to access the portal.

- Navigate to DRC-03: Under "Services," go to "My Applications" and select DRC-03.

- Enter Payment Details: Fill in the payment details, including the payment reference number.

- Submit the Form: Check and submit the form.

- Acknowledgement: Save the acknowledgement for future reference.

Filing DRC-03 right after payment helps keep your tax liability record up-to-date, reducing the chances of penalties or interest charges due to late filing or payment mismanagement.

How Can I Download Paid DRC-03 Acknowledgement?

To download the acknowledgement for a paid DRC-03, follow these steps:

- Log In to GST Portal: Access the GST portal using your login details.

- Go to My Applications: Navigate to "My Applications" under the "Services" menu.

- Select DRC-03: Find the DRC-03 form for which you need the acknowledgement.

- Download Acknowledgement: Click on the "Download" option next to the relevant form entry to get the acknowledgement.

Having a downloaded copy of the acknowledgement provides proof of payment and can be useful during audits or when responding to queries from GST authorities.

Public FAQs

1. What is the main purpose of the gst drc-03a form?

The gst drc-03a form is used to adjust voluntary payments against specific demand orders, ensuring that payments are accurately matched to the respective demands.

2. How can I ensure that my payment is correctly linked

to a demand order using gst drc-03a?

You can ensure correct linkage by entering the specific Demand Order Number in the gst drc-03a form while filing it on the GST portal.

3. Is it mandatory to use form gst drc-03a for all demand

adjustments?

Yes, for adjustments related to specific demand orders, using form gst drc-03a is mandatory to ensure accurate recording and reconciliation of payments.

4. Can I correct errors in a previously submitted gst

drc-03a form?

Yes, if there are errors in the submitted gst drc-03a form, you can rectify them by submitting an amendment request through the GST portal.

5. Where can I find the gst drc-03a form payment link on

the GST portal?

The gst drc-03a form payment link is available under the "Services" section in the GST portal, which can be accessed by logging in with your credentials.

Read Also: Key Takeaways from the 55th GST Council Meeting

Summary

The introduction of GST DRC-03A by GSTN is an important update that ensures clarity and accuracy in adjusting tax payments against demand orders. By using this form, taxpayers can avoid problems caused by unmatched payments and keep their compliance records current. Knowing how to file and link these forms will help in smooth tax operations.

Also, staying updated about changes to GST forms and processes can help in better financial management and compliance. Businesses and tax professionals should keep learning about these changes to give accurate advice and stay compliant with the rules.