Whether you're from the US, India, or the UK, understanding stock fundamental data is crucial if you’re keen on investing wisely. This guide will walk you through the essentials in a detailed, yet simple, manner, ensuring you grasp how it works, its importance, and how you can use it to make better investment decisions. So, let’s get started on this financial journey together!

What Is Stock Fundamental Data?

Let’s break it down to basics. In simple terms, stock fundamental data includes all the vital financial and operational information about a company that investors use to gauge its performance and health. Think of it as the company’s financial health report – the kind you’d want to read before making any serious investment decisions.

What Does Stock Fundamental Data Include?

The core elements of stock fundamental data are quite universal, though the way they are reported might vary slightly between countries. Here’s what you’d typically find:

- Income Statement Data: This is where you see how profitable a company is by looking at its revenue, expenses, and net income. It’s like checking how much money the company makes versus how much it spends.

- Balance Sheet Data: This gives you a snapshot of what the company owns (assets), what it owes (liabilities), and the shareholders' equity. It’s like a financial selfie showing the company's health at a particular moment in time.

- Cash Flow Statement Data: It shows how well the company manages its cash – from how much cash it brings in to how much it spends. This is crucial because a company might look profitable on paper but could struggle with cash flow.

How Does It Work?

Companies in the US, India, and the UK are required to publish detailed financial reports. In the US, public companies file their reports with the Securities and Exchange Commission (SEC). In India, companies file with the Securities and Exchange Board of India (SEBI), while in the UK, they report to the Financial Conduct Authority (FCA).

These reports are then used by analysts and investors to calculate financial ratios, project future earnings, and assess the intrinsic value of companies. Essentially, you’re peeling back the layers to see what the company is really worth, beyond its market price.

Why Is It Important?

Understanding stock fundamental data is like having a superpower in the investment world. Here’s why it’s important:

- Make Informed Decisions: Whether you're investing in Apple (US), Infosys (India), or Unilever (UK), knowing the company’s fundamentals gives you a clear picture of what you're buying into. It’s not just about the stock price but the real value behind it.

- Focus on Long-Term Investments: Fundamental analysis encourages a long-term view, focusing on a company’s potential for growth and stability. This is especially valuable if you’re planning to hold onto your investments for years.

- Identify Investment Opportunities: It allows you to spot undervalued stocks. For example, a company might have strong fundamentals but is currently undervalued due to temporary market conditions. This is where the true investment potential is.

Where Can You Find Fundamental Data?

Accessing fundamental data is straightforward, and there are platforms tailored to each country:

|

Fundamental Analysis

Now that you understand what stock fundamental data is, let’s dive into fundamental analysis, the process of evaluating this data to determine a company’s intrinsic value.

Read Also : How the Fed's Decisions in America Impact Gold and Silver Prices in India

What Is Fundamental Analysis?

Fundamental analysis involves examining a company's financial statements, industry conditions, and broader economic trends to assess its health and potential. It’s like being a detective, piecing together various clues to see if a stock is worth your investment.

The Basics of Fundamental Analysis

Fundamental analysis includes three key areas, all of which play a role in understanding a company’s true value:

- Economic Analysis: This involves understanding the overall economy and how it might affect the company. For instance, in the US, investors pay attention to Federal Reserve policies, while in India, they look at the Reserve Bank of India’s actions. In the UK, factors like Brexit and Bank of England policies are significant.

- Industry Analysis: Understanding the industry in which a company operates is crucial. Each sector has its unique dynamics, whether it’s technology in Silicon Valley, IT in Bangalore, or banking in London.

- Company Analysis: This is where you dive deep into the company’s financial statements and compare its performance with competitors and industry standards.

Types of Fundamental Analysis

There are two main types of fundamental analysis:

- Quantitative Analysis: This involves numbers like earnings, revenue, and debt. It’s about the hard data that can be measured and compared.

- Qualitative Analysis: This focuses on non-numerical factors like brand strength, management quality, and industry position. It’s more about the company’s image and strategic advantages.

Principles of Fundamental Analysis

Let’s discuss some core principles:

|

Examples

|

Starting Fundamental Analysis as a Beginner

If you’re new to investing, starting with fundamental analysis can seem daunting. But don’t worry, here’s a simple roadmap:

- Learn Financial Statements: Understand the basics of the income statement, balance sheet, and cash flow statement. It’s the foundation of fundamental analysis.

- Key Ratios: Familiarize yourself with important financial ratios like P/E (Price to Earnings), ROE (Return on Equity), and D/E (Debt to Equity). These are critical tools for comparison and analysis.

- Stay Updated: Follow economic news and trends in your respective country. Whether it’s the Federal Reserve in the US, the RBI in India, or the Bank of England, staying informed is key.

- Practice: Use demo accounts or mock investments to practice your analysis without risking real money.

Top Stock Analysis Websites for Investors Around the

World

Finding the right

resources for stock analysis is crucial when you want to make smart investment

choices. Whether you're in the US, India, or the UK, here are some of the best

websites to help you track stock performance, get the latest market updates,

and do your research.

For Investors in the US:

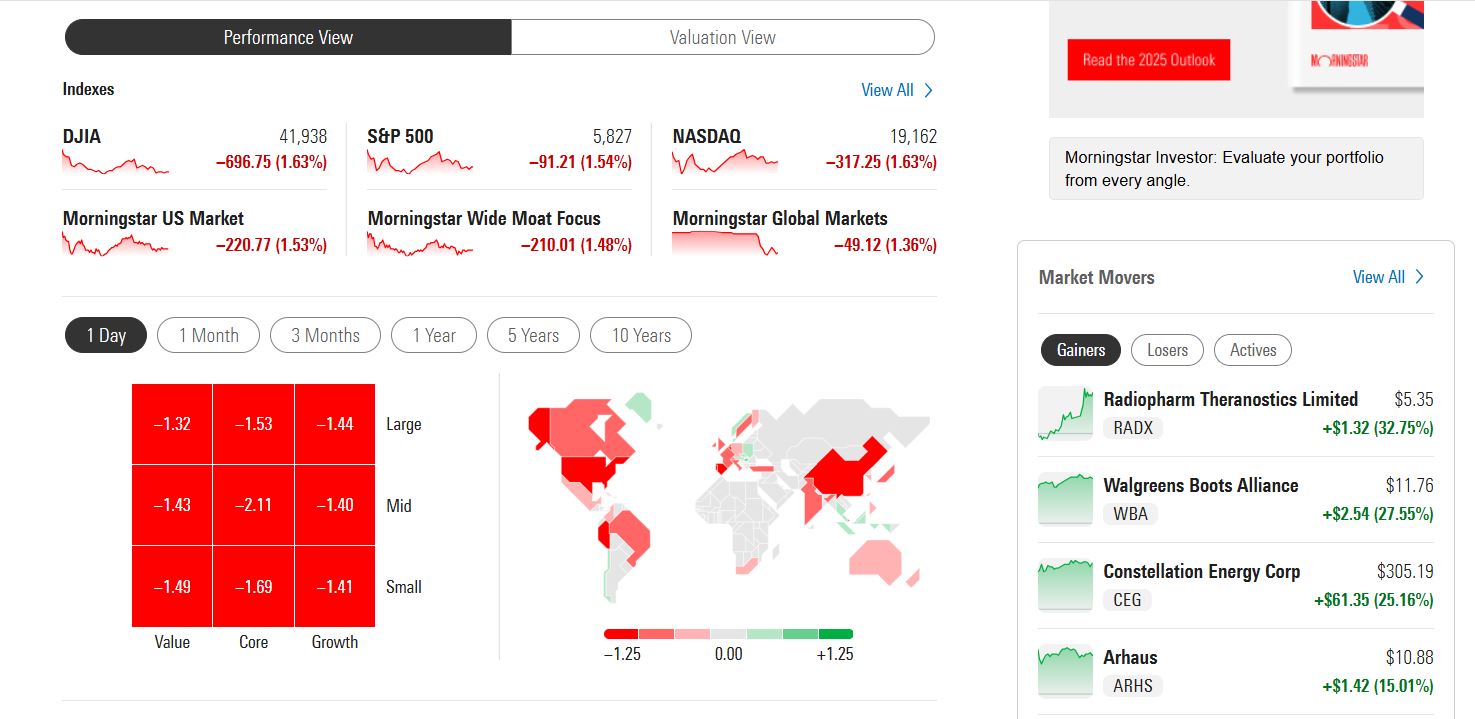

Morningstar

Morningstar is well-known for providing detailed research on stocks, mutual funds, ETFs, and more. It offers ratings, analysis, and performance data, helping investors make informed decisions about where to put their money.

SEC EDGAR

For more serious research, the SEC EDGAR database is a must-visit. It's where US public companies file important documents like annual reports (10-K) and quarterly reports (10-Q), giving you access to detailed financial data directly from the companies.

Screener

Each of these

websites offers useful tools and information for investors. Whether you're new

to stock trading or a seasoned investor, these platforms can help you stay

informed and make smarter investment decisions.

How to Read an Annual Report for Beginners

Annual reports are essential documents for understanding a company's performance, strategy, and financial health. While the format can vary slightly between companies and regions, the core components remain the same. Here’s a simple guide to help you read and interpret an annual report effectively.

1. Chairman’s Letter

The Chairman's Letter is typically the first section of an annual report and provides an overview of the company’s vision, achievements, and challenges. This letter often sets the tone for the rest of the report, offering a high-level summary of the company's direction and performance. It’s an important section to understand how the leadership views the company's future and how it has navigated the past year.

2. MD&A (Management Discussion & Analysis)

The MD&A section offers management’s perspective on the company’s operations, financial results, and strategy. This section provides a deeper dive into the company’s performance, including an analysis of the key drivers behind the results, challenges faced, and opportunities ahead. It also typically covers plans for the future, including strategic initiatives, market conditions, and potential risks.

3. Financial Statements

Financial statements give you a clear picture of a company's financial health and performance for the year. The main types of financial statements are:

|

These statements are critical for assessing profitability, financial stability, and the company’s ability to generate cash.

4. Notes to Accounts

The Notes to Accounts section is often overlooked but is incredibly important. It provides detailed explanations of the accounting policies used by the company and offers additional context for the financial statements. This section may cover topics such as revenue recognition, tax policies, and any unusual items or transactions that impacted the company’s financial results. It helps investors and analysts get a clearer picture of how the company’s numbers are calculated and what they truly mean.

Read Also: Are IPOs a Good Start for Beginners?

Fundamental Analysis Calculations

Let’s look at some key calculations that apply universally:

|

Examples of Fundamental Analysis Calculations

Here are some common calculations used in fundamental analysis:

- Price-to-Earnings (P/E) Ratio:

- Return on Equity (ROE):

- Dividend Yield:

- Debt-to-Equity Ratio:

Stock Fundamental Data API

For those tech-savvy investors and developers, APIs can automate the fetching of fundamental data, making analysis more efficient.

Where to Get an API Key

|

Final View

Understanding stock fundamental data and using fundamental analysis are essential skills for any serious investor. Whether you’re in the US, India, or the UK, these principles will guide you to make smarter investment decisions. Remember, it’s all about looking beyond the stock price to see the real value of a company. Take your time, practice your analysis, and happy investing!

Public FAQs on Stock Fundamental Data and Fundamental

Analysis

1. What is stock fundamental data?

Stock fundamental data is basically the financial information about a company. It includes things like its earnings, debts, assets, and cash flow. This data helps investors understand how well a company is doing and whether it’s worth investing in or not.

2. Why is fundamental data important?

Fundamental data is important because it tells you the true financial health of a company. Instead of just looking at how the stock price is moving in the short term, it gives you a clearer picture of how the company is performing over the long run. It helps you figure out if the stock is priced fairly based on its actual value.

3. Where can I find stock fundamental data?

You can find stock fundamental data on different websites, depending on where you live:

|

4. What is fundamental analysis?

Fundamental analysis is the process of looking at a company’s financial health to figure out if its stock is a good investment. You’ll look at things like earnings reports, balance sheets, and other financial data to understand if the company is doing well or struggling. It helps you make decisions about whether to buy or sell a stock.

5. How can I start with fundamental analysis if I'm a

beginner?

If you’re just starting, focus on understanding a company’s basic financial statements like its income statement, balance sheet, and cash flow statement. Look at key numbers like the Price-to-Earnings (P/E) ratio and Return on Equity (ROE). Don’t worry if you don’t understand everything at once—it takes time, but with practice, you’ll get the hang of it.

6. How does fundamental analysis differ from technical analysis?

Fundamental analysis focuses on a company’s financial health and intrinsic value, while technical analysis looks at past price movements and trading volumes to predict future price trends. Both approaches are valuable, but fundamental analysis is typically used for long-term investing, while technical analysis is more suited for short-term trading.

7. What is the intrinsic value of a stock?

The intrinsic value of a stock is the true worth of the company, calculated using fundamental analysis methods. It considers a company’s earnings, assets, and potential growth. By comparing intrinsic value with the stock’s market price, investors can determine if a stock is under or overvalued.