Ever feel like your salary disappears before you know it? With rising expenses and inflation, it’s not surprising. But what if you could earn as much on the side as your salary? Imagine earning another ₹40,000 on top of your monthly income. Sounds exciting, right? Let’s break down exactly how you can make this happen.

Why You Need a Side Income

Let’s face it—life isn’t getting any cheaper. Rent, groceries, and bills all pile up faster than we’d like. Plus, with so many people turning to personal loans to make ends meet, it’s clear that a single income often isn’t enough. That’s why having a side income can be a game-changer. It’s like creating a financial shield for peace of mind. And if you’re working a private job, this is something you absolutely need to consider.

The Simple Side Income Formula

Here’s the magic formula: Save and invest wisely. If your salary is ₹40,000 a month, try to save 35% of it. That’s ₹12,000 every month. Now, don’t just let that money sit idle in your savings account. Instead, put it into a Systematic Investment Plan (SIP). SIPs in mutual funds can give you solid returns over time. On average, you could earn about 12-15% annually.

Let’s Crunch the Numbers

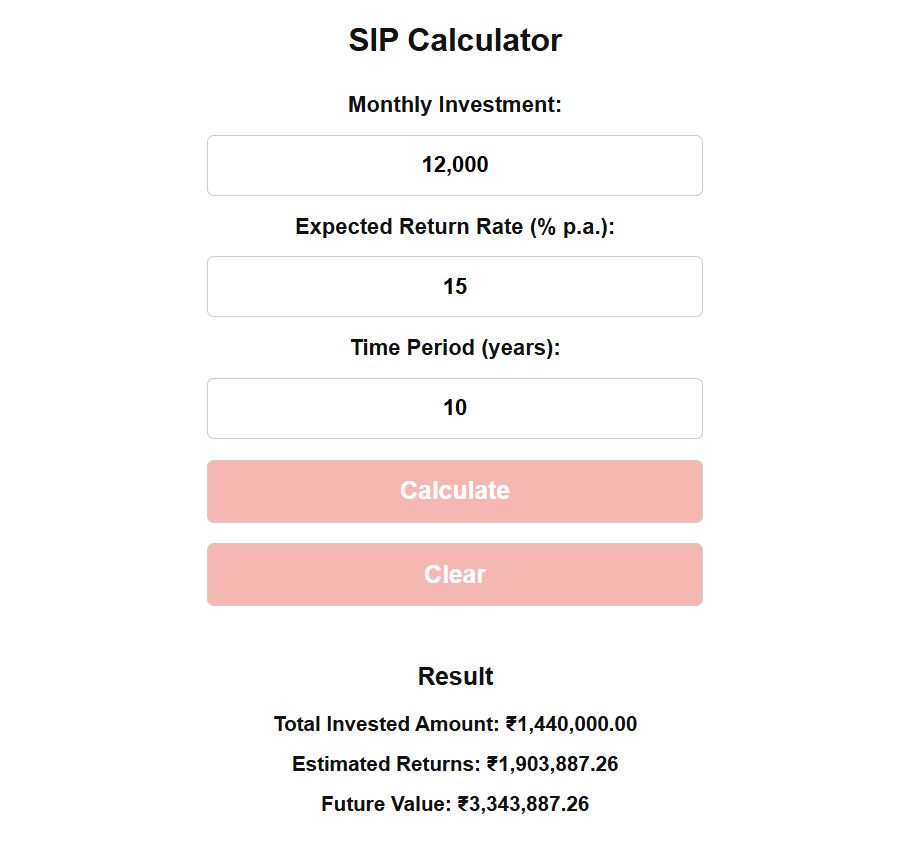

If you start investing ₹12,000 each month in an SIP Systematic Investment Plan, here’s how your money can grow:

- After 5 Years: Your investment could grow to around ₹10.76 lakh at a 15% annual return.

- After 7 Years: Your total could reach approximately ₹18 lakh.

- After 10 Years: You’re looking at nearly ₹33.44 lakh.

It’s amazing how consistent saving and investing can transform your financial future.

Boosting Your Investments as You Grow

Most people’s salaries double in 9-10 years. If you’re earning ₹40,000 now, chances are you’ll be making over ₹80,000 in a decade, especially with a 10% annual increment. Now imagine increasing your SIP contributions as your salary grows. By the 10th year, you could be investing ₹28,000 monthly instead of ₹12,000.

Here’s what that means:

- With this increased investment, your total wealth at a 15% annual return could jump to ₹47.48 lakh in 10 years. That’s huge!

What to Do with All That Money?

Once you’ve built this wealth, it’s time to make it work for you. Here’s how:

- Fixed Deposits (FDs):

Put your ₹47.48 lakh in an FD and you could earn over ₹1 lakh to ₹1.5 lakh in interest according to invested in years. almost like having a second salary.

- Reinvest for More Growth:

Use the returns to create even more wealth. You could explore real estate, dividend-paying stocks, or other investment options.

How to Get Started

- Set a Goal:

Choose how much you'd like to put aside each month. Start with 35% of your salary if possible.

- Open an SIP:

Research mutual funds and pick one that fits your goals and risk appetite. Don’t hesitate to consult a financial advisor.

- Stay Consistent:

The key to achieving success is consistency in your approach. Avoid withdrawing your investments prematurely.

- Scale as You Grow:

Increase your SIP contributions as your salary rises to speed up your wealth creation.

Why This Plan Works

Financial Freedom: You’ll no longer rely solely on your paycheck.

Stress-Free Living: Extra income means less financial stress and more peace of mind.

Big Dreams, Bigger Possibilities: Use your side income for vacations, a new home, or even early retirement.

Emergency Backup: Build a safety net to handle unexpected expenses without worry.

A Word of Caution

Remember, mutual funds are subject to market risks. Always read the scheme-related documents carefully and consult a financial expert before investing. The key is to stay disciplined and not panic during market fluctuations.

Final Thoughts

Making a side income equal to your salary isn’t just a dream—it’s entirely doable. By saving 35% of your salary and investing it in an SIP, you can build significant wealth over time. As your salary grows, increase your investments to amplify your results. With patience and consistency, you’ll not only secure your future but also achieve the financial freedom you’ve always wanted.

So, what are you waiting for? Take small steps, stay consistent, and watch your wealth grow over time. Ready to begin? Use our SIP Calculator today and take the first step toward doubling your income!

Public FAQs

Q1: What is a Systematic Investment Plan (SIP)?

SIP is a method of investing in mutual funds where you contribute a fixed amount regularly (e.g., monthly). It helps you build wealth over time through disciplined investing.

Q2: Can I start an SIP with less than ₹12,000?

Absolutely! You can start an SIP with as little as ₹1000 per month. The secret lies in beginning your investment journey early and expanding it as your income rises.

Q3: What if I need to withdraw money from my SIP?

You can withdraw money from your SIP at any time, but it’s best to stay invested for the long term to maximize returns.

Q4: What happens if I miss an SIP installment?

Missing a payment isn’t the end of the world. Most mutual funds allow you to continue investing without penalties, but it’s best to stay consistent.

Q5: Can my SIP amount be increased later?

Yes, you can increase your SIP amount anytime. As your salary increases, you can enhance your SIP contributions using step-up features.